Double Materiality: how to focus on the issues that matter the most

The EU’s Corporate Sustainability Reporting Directive has been a hot topic since January. This August, the first set of European Sustainability Reporting Standards (ESRS) were published. In effect, these are the ‘how to guides’ for aligning with CSRD requirements. Affected companies will be required to report as early as 2024 in line with these reporting standards. Companies within and out of the EU can expect to feel the ripple effects of these reporting standards. If Double Materiality is now at the top of your agenda, read further to get familiar with what it is, how to perform them and future drivers for EU and non-EU companies.

Single Materiality, Double Materiality – what’s the difference?

Firstly, Materiality Assessments is the process you would carry out to find and prioritise issues for your company. The different types of materiality are the filters you’d apply to this process, depending on what question you’re trying to answer. Let’s clear the air by looking at the different types and defining them in the style of questions you’d use them to answer.

1. Financial, or single, Materiality

What specific social or environmental issues impact (positive or negative) future cash flow or overall company value for our company?

E.g. impact of workforce diversity on performance levels

2. Impact Materiality

In what specific ways does our company’s operations impact (positive or negative) society or the environment?

E.g. impact of company operation on air quality/pollution

3. Double Materiality (combined)

In what ways is our company financially affected by social and environmental issues, and what is our impact on those same issues?

E.g. impact of company on climate change (emissions, pollution), and climate change’s impact (extreme weather changes, air quality, food supply) on the company.

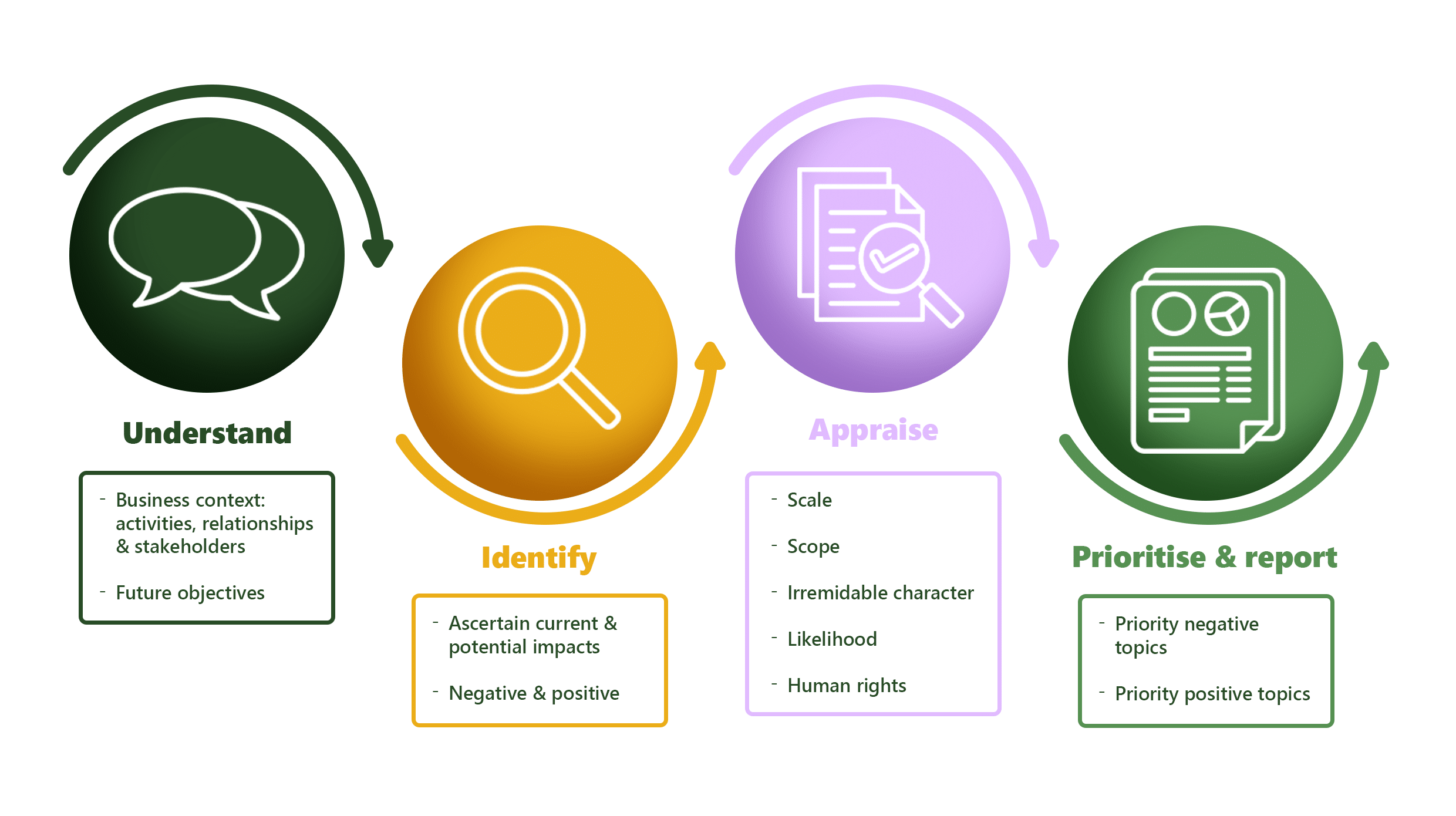

How to appraise materiality

Top-level, here are the main steps involved in performing a materiality assessment:

- Identify sustainability matters and topics of relevance to your company, value-chain and industry

- Consultation of stakeholder groups and experts who may be affected (positively or negatively) by your company’s decision or actions.

- Appraise each topic against 3 criteria: Scale (how critical e.g. non-compliance) , Scope (who, what and degree of the effects of the issue), and Irremediability (how hard it is to fix the issues once it’s happened)

- The significance of the impact: The severity plus the likelihood of the impact occurring

You should aim to understand severity by evaluating against other potential impact areas. E.g., analysis of GHG emissions against other impacts, rather than against global GHG emissions. Not doing so can result in misleading conclusions.

Human rights issues, e.g., child labour in your supply chain, is an exception and in the instance any human rights violations is suspected this will take precedence over likelihood considerations. For example, a nuclear power station may prioritise impact related to loss of life in case of natural disasters, despite a low likelihood of a natural disaster, due to the irremediable impact.

Expert note: don’t stop at negative impacts. Perform this process for positive impacts also. During the final prioritisation process, find the that represent highest negative impacts areas for harm reduction, and highest positive impact areas to enable you to maximise regenerative actions.

Our process for helping your company determine double materiality

Future-drivers in ESG reporting

The thoroughness of ESG reporting is expanding as CSRD borrows and builds on requirements set out as part of voluntary reporting disclosure frameworks such as Global Reporting Initiative (GRI) and International Sustainability Standards Board (ISSB). In doing so, CSRD are moving the dial and showcasing the direction of travel even for companies that aren’t currently legally required to comply with CSRD. These frameworks sit behind ESG ranking agencies such as CDP, ISS, Sustainalytics and S&P. If your company want to maintain positive rankings for investors and stakeholders, adopting reporting standards set out by CSRD, including double materiality, is strongly recommended.

Luckily, at Sustainit we’re perfectly positioned to support companies of all sizes in determining double materiality. We can guide you through the double materiality process, engaging with stakeholders and prioritising topics. Take a look at our range of consultancy services.