When does it apply?

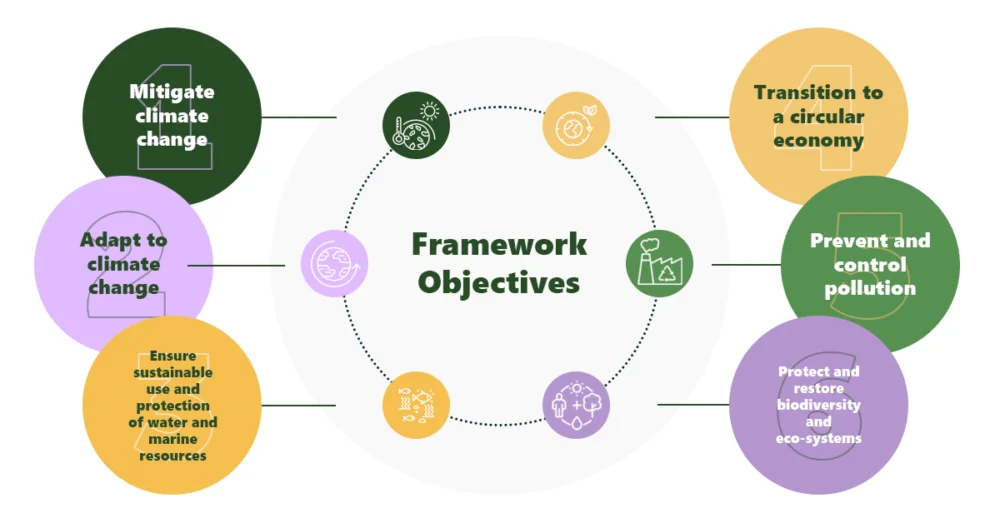

Adopting a staged approach, to help businesses plan and adapt, EU taxonomy came into force partly in January 2022. From the 1st of January to the 31st of December 2022 businesses were required to report on the first two objectives (climate change mitigation and climate change adaptation) for their FY year 2022. On the 1st of January 2023, the requirement to report on the 4 others came into force. But the European Commission is yet to publish the Delegated Acts that explain the technical screening criteria for the 4 other objectives – we’re sitting tight and waiting for the information to be published.

These reports must include information on technical screening criteria, which is defined as the process of classifying the minimum requirements necessary to avoid significant harm to other objectives, whilst significantly contributing to at least one of the 6 environmental objectives. The rules set out in the taxonomy supporting guidance (The Delegated Act) have been implemented to enable companies to translate the technical screening data into quantitative economic performance indicators, or KPIs. It’s these KPIs, supported by qualitative data, that will be publicly disclosed in their reports and available for consumers and investors to see. [3]

So, the time to act is now!

There is no denying that navigating these taxonomy requirements is complicated. However, there are some simple steps you can take to ensure that you are doing everything within your power to be compliant:

- Check whether you are in line with a set of globally recognised minimum social standards

- Check what your business is already doing in terms of sustainability, and track this against the 6 objectives

- Ensure that your business activities don’t cause any significant harm to the 6 objectives

- Keep up to date with updates from the European Commission on changing standards with regards to technical screening criteria and how to translate this into KPIs specific to your business

EU Taxonomy – an evolving beast

The requirements of the EU taxonomy regulations are the central pillars within the wider sustainability reporting regime. They underpin the EU’s sustainable finance strategy, as part of the Green Deal. Although already partly in force, the system is continuously evolving and it’s expected to be fully operational by 2026. These standards and reporting requirements will likely continue to change, so it’s important to keep your finger on the pulse and avoid any sanctions for failure to comply. There have also been many recent updates surrounding a possible UK taxonomy, so read our blog post outlining what that may look like here.

[1] https://home.kpmg/uk/en/home/media/press-releases/2022/10/worlds-top-companies-improving-climate-reporting.html

[2] https://financialregulation.linklaters.com/post/102i3ha/fca-seeks-views-on-retail-disclosure-in-a-world-without-uk-priipsh

[3] https://www.simmons-simmons.com/en/publications/clbnur7r900e0twyk9pcto2kw/the-future-uk-retail-disclosure-regime-the-fca-opens-a-discussion